.png?width=365&name=52925%20Forbes%20Blog%20Thumbnail%20Image%20-%20Website%20(2).png)

First Insight Blog

Check out our blog posts for a broad-ranging overview of market trends, research findings, and company news.

.png?width=365&name=52925%20Forbes%20Blog%20Thumbnail%20Image%20-%20Website%20(2).png)

First Insight Blog

AI Took Over NRF 2025: Will Your Brand Keep Up or Fall Behind?

First Insight Blog

How is AI Transforming Merchandise Planning?

-1.png?width=365&name=Candle%20Nightmare%20%20B%26BW%20(3)-1.png)

First Insight Blog

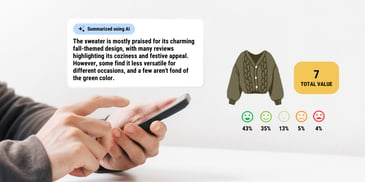

Gen AI – Saving Time and Getting Closer to Your Customers

First Insight Blog

The TikTok Challenge: Managing Inventory and Demand Spikes

First Insight Blog

How Unified Retail Teams Can Win Planning for Holiday and Seasons Beyond

First Insight Blog

Insights and Strategies for Footwear Retailers for Back-to-School

First Insight Blog

Stepping into the School Year: Key Footwear Trends for Back-to-School

First Insight Blog

Candid Conversations about AI and Retail

First Insight Blog