As the holiday season approaches, the report, The State of Consumer Spending: Retail Holiday Shopping Trends 2023, offers valuable insights into the evolving shopping habits and preferences of consumers. Understanding these trends is crucial for retailers aiming to maximize their holiday sales and for consumers seeking the best shopping experiences.

1. Holiday Shoppers Start Earlier

KEY FINDINGS- 50% of shoppers start holiday shopping before Thanksgiving, while only 7% wait until a few weeks before Christmas.

- Gen Z is 50% less likely to shop before October and the most likely to rush to the store for last-minute purchases.

- 53% of respondents plan to use social media to assist and research holiday gifting.

As the holiday season approaches, there's a growing trend of early shopping to avoid the holiday rush and potential stock issues. Consumers are becoming more proactive in their shopping habits, realizing the benefits of starting their holiday shopping well in advance. Retailers should take note of this trend and adjust their strategies accordingly. By offering early promotions and incentives, they can encourage customers to start their holiday shopping sooner rather than later. This can help retailers manage their inventory more effectively, ensuring that they have sufficient stock to meet the increased demand during the holiday season.

2. Shipping Costs: A Key Driver for Online Purchases

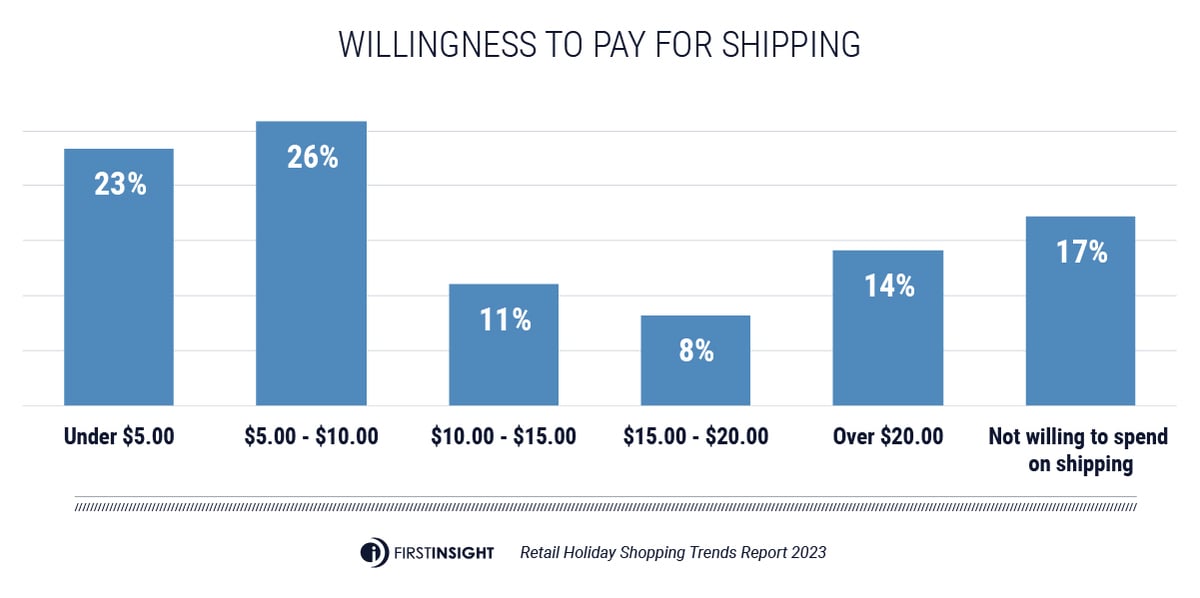

KEY FINDINGS- The influence of shipping prices on where consumers shop jumped by 62% this holiday season.

- A correlation exists between shoppers who will pay more for shipping - $15 or higher - and shoppers who will spend more this year.

- 1/3 of respondents are willing to pay at least $10 for shipping.

Shipping costs have emerged as a stronger deciding factor in consumers' online shopping choices, exerting a significant 62% influence this holiday season. Interestingly, concerns regarding shipping delays have waned, as most consumers anticipate a conservative 3-5 day delivery window. This shift in consumer expectations implies that retailers may need to reconsider the viability of expensive expedited shipping options and decide if the benefits outweigh the costs of offering speedy shipping.

3. Gifters Increasingly Shopping Both Online and In-Store

KEY FINDINGS- 16% more shoppers prefer to shop both in-store and online this holiday season.

- Top in-store purchases are apparel like casual wear and seasonal apparel while online shoppers are seeking tech and gadgets.

- Gifters prefer to shop at Big Box retailers and eCommerce marketplaces.

Top 5 Purchases for In-Store Shopping

1. Casual wear

2. Seasonal apparel & outerwear

3. Electronics, gadgets & video games

4. Beauty & personal care

5. Toys

Top 5 Purchases for Online Shopping

1. Electronics, gadgets & video games

2. Toys

3. Casual wear

4. Movies, subscriptions & books

5. Seasonal apparel & outerwear

The preference for shopping both online and in-store has risen by 16%, indicating more consumers are seeking a blend of digital and physical retail experiences. While in-store shoppers are drawn by price, the overall experience, including ease of shopping and customer service, is increasingly important. Retailers should focus on optimizing both channels, noting that apparel tends to dominate in-store purchases, while tech and gadgets are more sought after online.

4. Retailers Must Align with Customers on Return Policies

KEY FINDINGS- 3/4 of all respondents say they will be deterred from shopping with retailers that charge for returns.

- Over 50% of consumers return gifts due to fit/sizing, with only 13% of recipients returning gifts because they didn't like them.

- 75% of shoppers expect a 30-60 day return policy.

With the rising rate of returns retailers have no choice but to consider new return policies to manage these surging downstream costs. With most returning gifts because of poor fit or because they already own it, holiday shoppers may deserve more credit for picking out satisfactory gifts. Fortunately for retailers, only 1/4 of shoppers expect a return window of 90 days or more with nearly half expecting only 30 days. Staying competitive by offering extended holiday returns windows is not likely going to impact purchase decisions. Retailers must ensure return policies are both profitable and meet customer expectations to maintain customer loyalty and satisfaction; otherwise, extended return windows may just create more risk for return fraud and restocking costs.

5. Spending Set to Remain Steady

KEY FINDINGS

- A massive 87% of respondents will pay full price for a gift they know the recipient will love.

- Gen Z is almost 44% more likely to spend more this holiday season compared to other generations.

- 81% of shoppers are planning to spend the same or more than last year.

This year, consumers are showing a willingness to spend more, despite the challenge of getting less value for money due to rising prices. This trend is particularly strong among Gen Z, who are 44% more likely to increase their spending. In addition to spending more this year, a majority are ready to pay full price for gifts they believe will delight the recipient. Retailers should find ways to help shoppers find those most-wanted gifts, set appropriate pricing, and offer carefully curated selections in order to make the most of this eagerness to spend.

Conclusion

In order to gain a larger share of wallet this holiday season, retailers will need to delve deeper into consumer behavior data. Understanding which strategies will activate specific groups of shoppers and encourage them to spend can have a significant impact on overall sales. By utilizing voice of customer data, retailers can make informed decisions on various aspects such as which customer groups are likely to spend more on shipping and what other items they may be inclined to purchase.

Uncover the pulse of holiday shopping with our comprehensive State of Consumer Spending: Retail Holiday Shopping Trends 2023 report. This is your key to unlocking the full potential of your holiday sales strategies. Equip yourself with the latest consumer insights and be prepared to meet and exceed customer expectations. Download the full report now and stay ahead of the retail game!