The facts are easy: MPG, horsepower, technology, number of seats, safety features. But when it comes to your feelings about the car, a completely different part of the brain kicks in. Is this car “me”? Does it feel “right”? Do I love the color? Are the seats heated? Do I feel safe?

In retail, experience and intuition will always play a role, but today’s environment requires a combination of experience and data to maintain a competitive edge.

In a report released in January 2014 entitled “Retail Analytics Moves To The Frontline,” Retail Systems Research (RSR) presented a current view of the state of analytics and where retailers see value in using data across various areas of the organization. Retail was, and for some still is, an emotion-driven business. However, as the RSR report states, it is now more evident than ever that the retail industry is moving towards a stronger mix of data AND intuition-based decision-making.

We are accustomed to seeing data analytics used by marketing departments and the supply chain organization. What stood out to me in the RSR report was the fact that 80% of product development and merchandising departments are now data-oriented when it comes to decision-making. On the flip side, more than 40% of “laggards” (retailers with less than 3% comp store/channel sales growth) are merchandising and marketing solely on experience and intuition.

For retail “winners” (retailers with greater than 3% comp store/channel sales growth), the area listed as the top opportunity for greater use of analytics to drive business results was “More intelligent allocation and optimization of products based on customer insights.”

At First Insight we are seeing an acceleration in the number of retailers using our solution for just this purpose. Just last week, Trefis (a leading stock analysis and forecasting firm) wrote an article discussing the impact they expect First Insight’s predictive analytics to have on Abercrombie & Fitch’s business:

By leveraging First Insight’s data, Abercrombie will be able to invest in more relevant products, which can help it attract customers and operate with fewer markdowns.

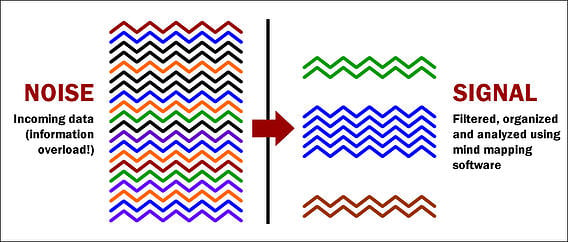

Hidden within the oceans of retail data are “signals” which contain insight that can help retailers figure out what customers want that require quick action. But not all “signals” that contain insights are obvious. There are benefits in “weak” signals, but it takes discipline and the right analytics to find these signals and make them actionable.

Weak Signals Produce Winning Ideas

An example of the successful identification and use of “weak” signals by Nordstrom was outlined in a February 2014 article by McKinsey and Company titled, “The Strength of ‘Weak Signals.’”

Nordstrom took an early interest in engaging consumers through social media and found that it was an excellent approach to identifying which products were resonating with customers in an open, social environment.

The article stated, “Spotting an opportunity to share this online engagement with in-store shoppers, the company recently started displaying popular items in two of its Seattle-area stores. When early results were encouraging, Nordstrom began rolling out the test more broadly to capitalize on the site’s appeal to customers as the “world’s largest ‘wish list.’ ”

Spotting these signals can yield actionable results, and applying predictive analytics can give retailers a much more focused picture that exposes the true customer behavior they are looking for.

Plan, Execute and Manage - Looking Forward, Not Back

Winning retailers know that data and analytics support the decision-making process rather than replace it. According to the RSR report, 66% of respondents said a mix of data and experience were used to make decisions in the product development group, and 69% of respondents said the same in the merchandising organization.

The most powerful signals in retail come from consumers. Identifying weak signals consumers generate through consumer engagement takes discipline. Today, technology makes it easier to convert these signals into clear decisions which drive margin gains. The power of predictive analytics lies in finding these signals and listening to the “right” customers about future needs.

At First Insight, we say: “Data is ubiquitous, Insights are rare.”

Successful retailers are getting the right data into the hands of their seasoned merchants, product designers and marketers – at the right time.

What has your data done for you lately?

Request a demo to see what many of the world’s leading retailers, brands and designers have found. Value.