Back-to-school season is upon us and despite recession fears, parents will still be on the hunt for school supplies, clothes, and shoes for their children. As the school year approaches, businesses should look at consumer spending trends to be at the top of their game.

FDRA + FFANY and First Insight ran a Back-to-School Footwear Shopper Survey Report to examine the shoe sales forecast and overall consumer behavior insights from families with school-aged children in the United States. This report, executed on the First Insight platform, gives businesses the confidence they need so they know what to expect for this upcoming school season. Here are five consumer trends gathered from the report that companies should be on the lookout for:

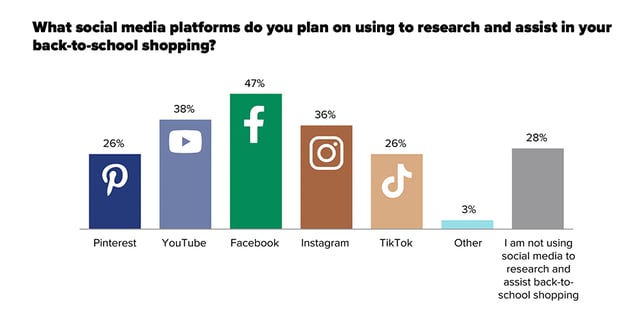

1. Using Social Media to Research Products and Trends

Social media platforms such as Facebook, YouTube, and Instagram continue to be popular for researching products and reviews before buying. The survey found that 61% of respondents would use social media to help with research for back-to-school purchases.

Kids pushing their parents for the coolest in back-to-school gear is tradition. Now, more than ever, they are using social media to discover the latest trends. Peer and social media influences on children are not news unto themselves, but it turns out these factors are affecting how parents spend their back-to-school dollars.

2. The Value of Sales, Sales, and More Sales

2. The Value of Sales, Sales, and More Sales

Price continues to be a major influence on families when shopping for the school year. As inflation increases and other outside factors change the market, consumers are becoming more mindful of affordability and how to stretch dollars. In a recent First Insight report on the effect inflation is having on consumer confidence, respondents said that they would be purchasing less-expensive groceries to cope with rising food prices. In order to stay competitive, brands should pay attention to what customers are saying and develop strategies that set them apart in the market.

3. Shipping Standards and Expectations

The eCommerce retail space has seen a rapid evolution over the past few years regarding customer delivery expectations. Previously, customers tended to expect goods to take up to 10 days to arrive, but as standard delivery options have shortened and expedited shipping options have become more affordable, the expectation of faster delivery has steadily increased. As online shoppers demand fast and cheap shipping options, the competition among retailers for these services has intensified.

Our 2021 consumer sustainability survey showed that if a company offered an incentive such as a 10% off coupon for the next purchase or reward points, 61% of shoppers would be fine with shipping taking 3 days or longer. This should come as good news for companies that are strategizing to combat record-high shipping costs.

4. Changes in Expectations to Spend More

Over 30% of respondents said they are expecting to spend up to $200 more each month on all purchases. With the absence of the child tax credit stimulus we saw last year, this is a large decrease in disposable income as we hit the back-to-school season.

Interestingly, a significant number of families earning less than $50,000 annually report that they are spending the same amount as last year. With little financial flexibility, these households may be cutting back on their overall spending.

5. Gas Prices

A common worry among consumers is the rising cost of gasoline. Sixty-seven percent of surveyors have turned to online shopping in order to save money on fuel costs. While this may seem like common sense, it helps reveal the psychology of the consumer. It allows companies to understand how external economic factors are squeezing funds and impacting how consumers are shifting how they're making purchases.

Conclusion

The increased prices of goods are causing consumers to branch out to different stores. The competition between chain retailers and discount retailers will become fiercer, as shoppers will find more products in stores such as TJ Maxx or Marshalls than last year. Chain retailers will have to work harder to keep their customers by offering fresh products at a reasonable and competitive price.

Predicting which products will be popular can help companies save money on inventory and increase sales. This is especially important for back-to-school shoppers, who are often looking for the best deals. By using predictive analytics, retailers can determine which products will capture the bulk of demand, confidently make buy-depth decisions, all while cutting down on waste and making sure that they have the most sought-after items available.

First Insight helps you engage your target consumers right from the start of the customer journey, so you can make the decisions that will maximize customer loyalty and drive business results.